Market Insights: What the "One Big Beautiful Bill" Means for Investors

WHAT THE "ONE BIG BEAUTIFUL BILL" MEANS FOR INVESTORS

Amid your enjoyment of hot dogs and fireworks earlier this month, you may have heard the news that President Trump signed his “One Big Beautiful Bill” into law on July 4, following extensive congressional negotiations. This new budget is far-reaching, including making many parts of the Tax Cuts and Jobs Act permanent, raising state and local tax exemptions, extending the estate tax limits, and much more. It attempts to offset some of these provisions with spending cuts in key areas such as Medicaid.

There are many angles from which to view the recently passed budget. What do investors need to know when it comes to their own financial plans and what it means for markets in the years to come?

HOW THE NEW LAWS MAY AFFECT YOUR FINANCES

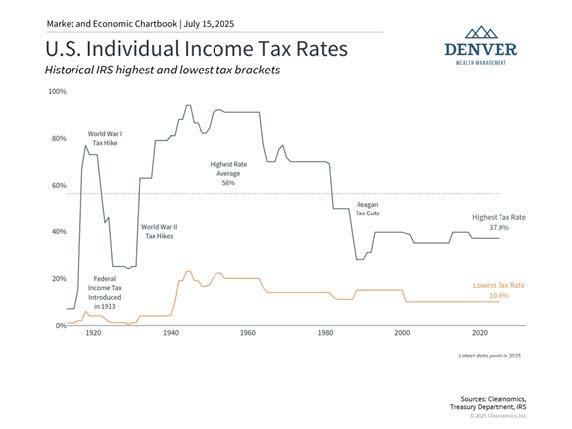

The administration's "One Big Beautiful Bill" permanently extends several major Tax Cuts and Jobs Act provisions while introducing new benefits. These changes maintain the relatively low-tax environment of recent decades, with current rates remaining well below historical peaks when top marginal rates often exceeded 70%.

Here are just some of the major provisions that may affect your household:

• Current TCJA tax rates and brackets are now permanent

They were originally set to expire at the end of 2025.

• The standard deduction increases

to $15,750 for single filers and $31,500 for joint filers in 2025.

• There is an additional $6,000 deduction for qualifying seniors

(sometimes referred to as a “senior bonus”) that phases out for gross incomes exceeding $75,000. The provision expires in 2028.

• The alternative minimum tax exemption is now permanent

It also increases phaseout thresholds to $500,000 for single filers, which will be indexed for inflation in the future.

• The child tax credit rises from $2,000 to $2,200 per child

with future adjustments indexed to inflation to maintain purchasing power over time.

• The state and local tax (SALT) deduction cap increases to $40,000

from a $10,000 limit with annual increases of 1% through 2029. It is then scheduled to revert back to $10,000 in 2030.

• A deduction for tip income capped at $25,000 annually

for workers earning less than $150,000, effective through 2028.

• Some green energy tax credits are repealed

including for electric vehicles and residential energy efficiency credits.

• The federal debt limit increases by $5 trillion

This will prevent Congress from having to debate and approve debt limit increases for some time, reducing political uncertainty.

• For businesses, the bill expands tax breaks

designed to encourage domestic investment and job creation.

FISCAL DEFICIT CONCERNS REMAIN

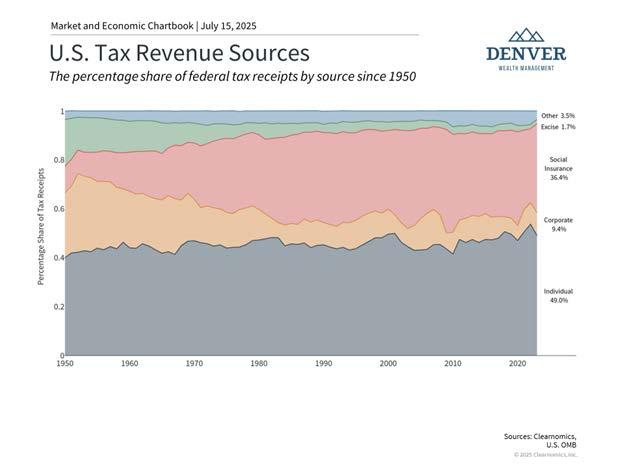

Tax policy and government deficits are two sides of the same coin. Tax cuts reduce government revenues which then need to be offset by either lower spending or increased borrowing. However, most government spending is for entitlement and defense programs which are politically difficult to change. According to the Department of the Treasury, in 2025 21% of government spending is for Social Security, 14% for Medicare, 13% is for National Defense, and 14% is to pay interest costs on the existing national debt.

The Congressional Budget Office estimates this legislation will add $3.4 trillion to national debt over ten years. Current federal debt exceeds 120% of GDP at $36.2 trillion, representing approximately $106,000 per American. Individual income taxes now constitute the primary federal revenue source, supplemented by payroll taxes for social programs.

For investors, tax policies can have direct implications on financial plans and portfolios. From a macroeconomic perspective, however, these implications have more limited effects. Over longer periods, higher national debt can influence interest rates and inflation expectations. While these factors have been relatively high in recent years, many of the worst-case scenarios have not yet occurred. The key for long-term investors is to maintain diversified portfolios that can perform across different fiscal and economic environments, rather than reacting to policy changes alone.

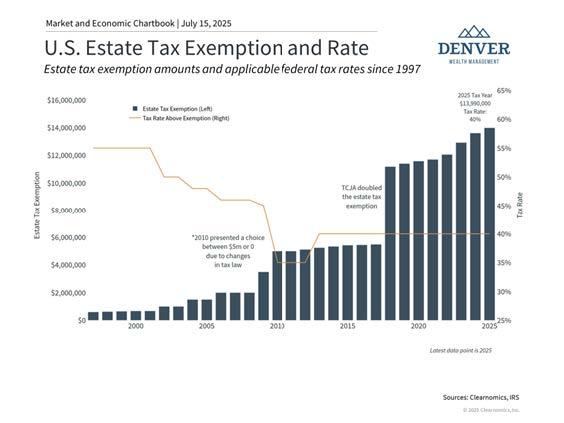

ESTATE TAX UPDATES PROVIDE LONG-TERM CERTAINTY

One aspect of tax policy that was in flux heading into this year is the estate tax exemption. The TCJA doubled these limits which were scheduled to revert to previous levels in 2026. However, the passage of the new tax bill makes these higher exemptions permanent, further increasing the threshold to $15 million for individuals and $30 million for couples in 2026.

While it may seem like estate taxes only apply to higher net worth households, the reality is that all families must consider how assets can be passed to future generations. This requires a comprehensive approach to planning that integrates estate planning, tax efficiency, philanthropy, and long-term wealth preservation goals. It’s also important to keep in mind that individual states can also impose estate taxes with exemption thresholds that are less favorable than the federal level.

THE BOTTOM LINE

The new spending and tax bill extends and expands the current low-tax environment. For investors, a properly constructed financial plan is designed with these tax provisions in mind. When it comes to growing deficits and the national debt, it’s important to not react with our portfolios, but to maintain a longer-term perspective.

Disclosures

This material is for general information only and is not intended to provide specific advice or recommendations for any individual.

There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Stock investing includes risks, including fluctuating prices and loss of principal.

All information is believed to be from reliable sources; however, Denver Wealth Management, Inc. and LPL Financial make no representation to its completeness or accuracy.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

The registered representatives are with and offer securities through LPL Financial. Member FINRA/SIPC. Investment advice offered through Denver Wealth Management, Inc., a registered investment advisor. Denver Wealth Management, Inc. and LPL Financial are separate entities. Denver Wealth Management, Inc. has common control and ownership.