Market Insights: Market Seasonality & Asset Allocation

What is going on in the market?—a question we have received several times over the past couple of weeks, which tells us, we need to address it.

Given recent market performance after a green surge to start the year, it's a valid question. So let's break it down:

WHY HAS THE S&P 500 DROPPED SINCE AUGUST 1ST (FOLLOWED BY OTHER ASSET CLASSES)?

The first facet to note is seasonality. Historically, long-term investors know September to be the S&P 500's worst-performing month:

- The last three Septembers have averaged a (-6%) decline.

- The August-September timeframe has been the weakest two-month period for stocks over all periods since 1950.

- Since 1950, September has ended positive less than half the time.

The good news is that the pattern tends to reverse in October and November, the strongest monthly pairing over the past 5 and 10 years. (LPL Financial)

So far, this phenomenon is playing out to a T, but only time will tell.

WHAT'S CAUSING THIS SEASONALITY?

There's good news and bad news.

The Good: Economic data remains strong, unemployment is low, and inflation is improving.

The Bad: While most of us want to wipe 2022 financials from our memories, we still feel the fallout today (and likely will still for months to come), including the likelihood of a high-interest-rate environment for longer than anticipated. When the economy is strong, the Fed can hold elevated rates.

This "higher-for-longer" economy has shown recently in the 10-year Treasury yield—the rate that most affects markets and consumers—which reached its highest level in '08.

SO WHAT?

On a lighter note, many economists believe the end of this now-18-month rate hiking cycle is near, if not already upon us. During the Federal Reserve's September meeting, Chairman Jerome Powell reiterated their intention to start cutting rates in 2024. A couple of triggering events may include a spike in the unemployment rate or, more favorably, decreasing inflation.

As investors, we believe now is a great time for a diversified portfolio. During periods of economic uncertainty, asset allocation can be an investor's best friend—equities can offer exposure to more upside capture if this seasonality pans out as it has historically, and bonds can offer more downside protection at attractive yields.

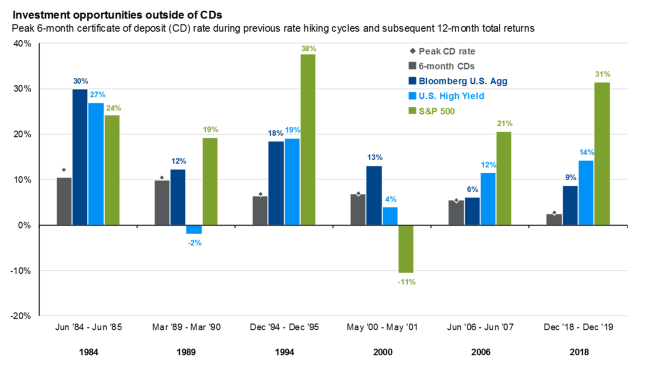

As for cash, the "safer" alternative tends to be the worst-performing asset class following rate hike cycles. The graph below shows the six previous cycles, and cash, as measured by the 12-month CD rate, tends to underperform stocks, aggregate bonds, and high-yield bonds in most circumstances. That's only to say that it may finally be time to bid farewell to those CDs that have served us well for the past 12 months.

Source: (9-30-2023) Guide to the Markets, J.P. Morgan.

Our Investment Committee will continue to monitor the investment landscape and act as needed. If you have any questions about your portfolio or outlook, please don't hesitate to call our office at (303) 261-8015.

For more of our thoughts, listen to the Mind of a Millionaire podcast, where hosts Zachary Bouck and Austyn Garcia share the team's October Portfolio Review Meeting recap.

Disclosures

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

Past performance does not guarantee future results.

Asset allocation does not ensure a profit or protect against a loss.

The registered representatives are with and offer securities through LPL Financial. Member FINRA/SIPC. Investment advice offered through Denver Wealth Management, Inc., a registered investment advisor. Denver Wealth Management, Inc. and LPL Financial are separate entities. Denver Wealth Management, Inc. has common control and ownership. The LPL Financial Registered Representatives associated with this site may only discuss and/or transact securities business with residents in the following states: AK, AL, AZ, CA, CO, DC, FL, GA, HI, IA, ID, IL, KS, KY, MD, MI, MN, MO, MT, NE, NV, NM, NY, NC, ND, OH, OK, OR, PA, SC, SD, TX, UT, VA, WA, WI, WY.