Market Insights: What the Dollar's Dip Means for Your Money

WHAT’S GOING ON WITH THE U.S. DOLLAR?

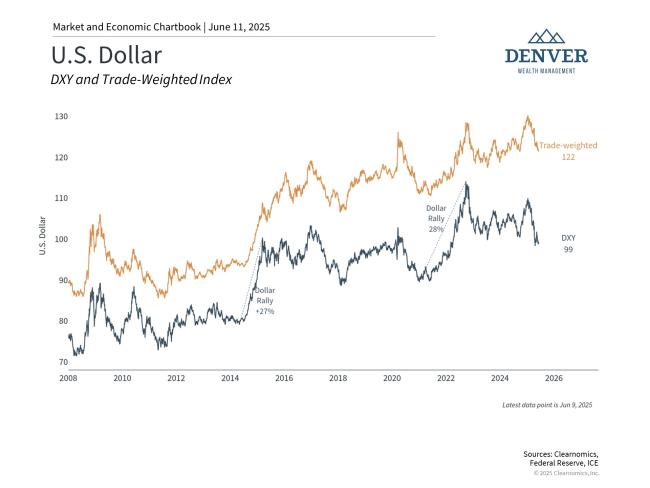

For many Americans, the dollar’s strength feels like a sign of national stability. So when it starts to slip—as it has recently—it naturally raises questions. Right now, the dollar is near its lowest level in three years against major global currencies, and some investors are wondering what that means for the bigger picture.

Let’s break it down:

THE DOLLAR’S ROLE IN THE WORLD

The U.S. dollar has been the world’s primary reserve currency for nearly 100 years. That means it’s the currency most countries prefer to hold and use in global trade.

From time to time, people have worried that other currencies—like the yen in the '80s, the euro in the 2000s, or digital currencies more recently—might challenge that status. But the dollar has remained dominant thanks to the size, strength, and stability of U.S. financial markets. In uncertain times, global investors still turn to the dollar as a safe haven.

WHAT MOVES THE DOLLAR?

Two major forces influence currency values: trade and interest rates.

When other countries buy U.S. goods or invest here, they need to convert their money into dollars, boosting demand. But when we import more than we export—as we did by about $1 trillion last year—it can pressure the dollar lower.

Interest rates matter, too. When the Federal Reserve raises rates higher than other central banks, investors often shift money into U.S. assets, strengthening the dollar.

WHY IT MATTERS FOR INVESTORS

While the dollar has dipped recently, it’s still near 20-year highs when you zoom out. Short-term fluctuations are normal.

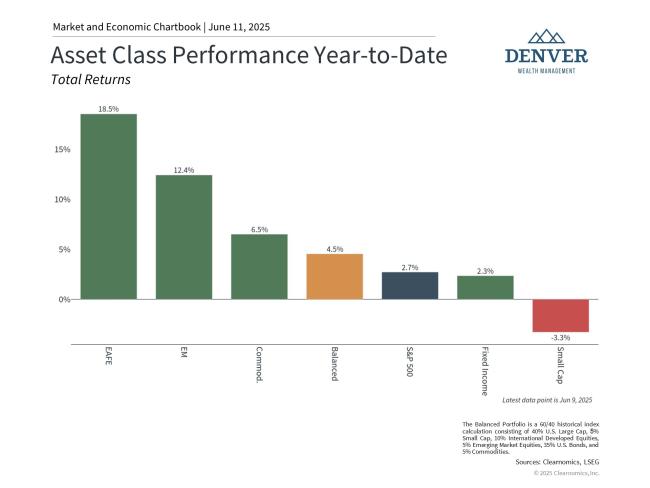

And here’s the silver lining: a weaker dollar can actually help investors. When the dollar falls, international holdings become more valuable when converted back to dollars. That’s one reason international stocks have outperformed U.S. markets this year.

The dollar’s global status isn’t vanishing anytime soon. And while currency shifts can make headlines, they also create opportunities—especially for well-diversified portfolios.

If you’re curious how this might impact your investment strategy, please don't hesitate to contact your advisor or schedule a free consultation on our website.

Disclosures

This material is for general information only and is not intended to provide specific advice or recommendations for any individual.

There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Stock investing includes risks, including fluctuating prices and loss of principal.

All information is believed to be from reliable sources; however, Denver Wealth Management, Inc. and LPL Financial make no representation to its completeness or accuracy.

All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

The registered representatives are with and offer securities through LPL Financial. Member FINRA/SIPC. Investment advice offered through Denver Wealth Management, Inc., a registered investment advisor. Denver Wealth Management, Inc. and LPL Financial are separate entities. Denver Wealth Management, Inc. has common control and ownership.